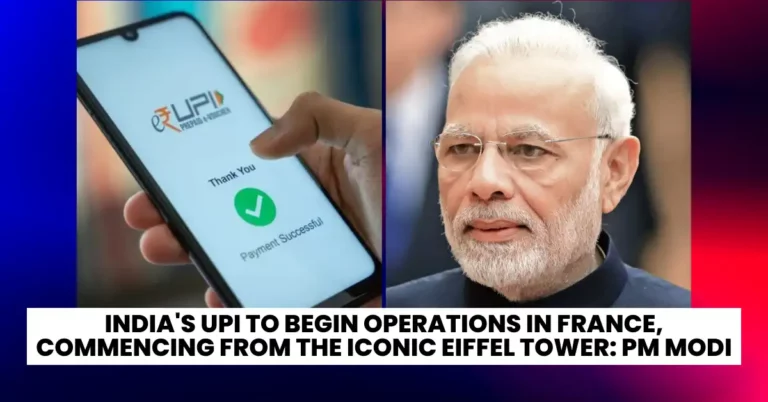

Prime Minister Narendra Modi announced that India’s Unified Payments Interface (UPI) will be used in France to make rupee payments, starting from the iconic Eiffel Tower. PM Modi made this announcement while addressing the Indian community in Paris on Wednesday.

Allowing UPI in France will significantly expand the possible spending options for Indians. UPI will be able to do away with bulky currency cards and eliminate the have to carry cash when making purchases.

PM Modi said that India and France have agreed to use UPI in France as part of their cooperation in the digital sector. He said that Indian tourists can make rupee payments using UPI from atop the Eiffel Tower.

“In France, an agreement has been made to use India’s UPI… It will be started from the Eiffel Tower, and now Indian tourists would be able to make payments in Rupees, through UPI, in the Eiffel Tower,” PTI quoted PM Modi as saying.

In France, an agreement has been made for the use of India’s UPI…It will be started from the Eiffel Tower, and now Indian tourists would be able to make payments in Rupees, through UPI, in Eiffel Tower.

– PM @narendramodi pic.twitter.com/8BTtvOXGzN

— BJP (@BJP4India) July 13, 2023

He added that UPI has brought a huge social transformation in India and he is happy that India and France are also working together in this direction.

Take a look at additional fresh content we have recently published:

- PM Modi Resolves OCI Card Issues and Expands Indo-French Collaboration in France Visit

- ISRO Receives Wishes From Bollywood Stars Akshay Kumar, Suniel Shetty, and Anupam Kher for Chandrayaan-3

PM Modi is on a three-day visit to France, where he will hold bilateral talks with French President Emmanuel Macron and attend the G20 summit. He will also inaugurate a memorial for Indian soldiers who died during World War I.

France is the second country after Singapore to adopt India’s UPI system for cross-border payments. Earlier this year, India’s UPI and Singapore’s PayNow signed an agreement that enables users in the two countries to make seamless, real-time, and secure cross-border transactions.